Does Money Impact Real Output Of Economy

ADVERTISEMENTS:

- Does Money Impact Real Output Of Economy Definition

- Does Money Impact Real Output Of Economy In America

- Does Money Impact Real Output Of Economy Pdf

- Does Money Impact Real Output Of Economy Graph

In this article we will discuss about the neutrality and non-neutrality of money.

Neutrality of Money:

Money supply has increased by 5%, the prices must increase by the same percentage change, prices must increase by 5%. This is what we called the neutrality of money over the medium run: monetary policy can only have a short run impact on the real economy. This impact is allowed by rigidities in. The real output level will remain unchanged at OY level. In the indirect mechanism, Thornton demonstrated that increase in money supply, by lowering the money- rate of interest relative to the real or natural rate, would create disparity between the actual and desired stock of real capital.

Neutrality of money means that money is neutral in its effect on the economy. A change in the money stock can have no long-run influences on the level of real output, employment, rate of interest, or the composition of final output. The only lasting impact of a change in the money stock is to alter the general price level.

Patinkin explains the neutrality of money as a situation when “a uniformly introduced increase in the quantity of money causes a proportionate increase in the equilibrium price of commodities and leaves the equilibrium rate of interest unaffected.” provided there is absence of money illusion and distribution effects.

Does Money Impact Real Output Of Economy Definition

ADVERTISEMENTS:

Does Money Impact Real Output Of Economy In America

According to Gurley and Shaw, money is neutral if money is either entirely of the “outside” variety, or entirely of the “inside” variety. They define neutrality of money as the “inability of changes in the nominal stock of money to affect the rate of interest, output and wealth, and other variables.”

In other words, money is neutral if it does not affect relative prices and leaves the interest rate unaffected. All prices move equi-proportionally. If this happens without a time lag, the neutrality of money is instantaneous. If there is a time lag, there is long-run neutrality.

There are changes in absolute (money) prices, but individual economic units are unresponsive to them. The quantity of money determines only absolute prices and their level does not affect the level of income, interest, rate of capital formation and employment. It is in this sense that money is neutral in its effects on the working of the economy.

Neutrality of Money in the Classical System:

In the classical system, money is neutral in its effect on the economy. It plays no role in the determination of employment, income and output. Rather, they are determined by labour, capital stock, state of technology, availability of natural resources, saving habits of the people, and so on. In the classical system, the main function of money is to act as a medium of exchange. It is to determine the general level of prices at which goods and services will be exchanged.

ADVERTISEMENTS:

Does Money Impact Real Output Of Economy Pdf

The quantity theory of money states that price level is a function of the supply of money. Algebraically, MV = PT, where M, V, P and T are the supply of money, velocity of money, price level, and the volume of transactions (or total output) respectively.

The equation tells that the total money supply, MV, equals the total value of output, PT, in the economy. Assuming V and T to be constant, a change in M causes a proportionate change in P. Thus money is neutral whose main function is to determine the general price level at which goods and services exchange.

The notion of neutrality of money in the classical system is explained in terms of Fig. 1. where we start with an initial full employment equilibrium position with N0, Q0, W/P0, M0, P0, and W0, as illustrated in Panels (A), (B), (C) and (D) of the Figure. The initial equilibrium is disturbed when the quantity of money is increased from M0 to M1. This leads to a rise in effective demand from MV0 to MV, as shown in Panel (C).

This raises commodity prices in proportion to the rise in M, since real output, Q0, is fixed. In other words, the rise in P by P0P1=MgM1 the rise in M. With the increase in the price level, the money wage rate will rise as rapidly as prices to W1– P1 (Panel D) in order to keep the real wage rate W/P0 unchanged (Panel B). But with increase in the price level, the real wage rate tends to decrease from W/P0 to W/P0 as shown in Panel B of the figure. This increases the demand for labour by more than the supply of labour which is shown by the distance sd in Panel B.

ADVERTISEMENTS:

The competitive bidding for labour will ultimately lead to rise in the real wage rate to W/P0, whereby the labour market equilibrium is restored at point E. Thus the result of an increase in money is to raise money wages and prices in equal proportion, leaving output, employment and the real wage rate unaffected. It is in this sense that money is neutral in the long run in the classical system.

Conditions for Neutrality of Money:

Patinkin and Gurley and Shaw have pointed towards certain conditions or assumptions which must be met to establish the neutrality of money.

1. Wage and Price Flexibility:

ADVERTISEMENTS:

There must be wage and price flexibility. If prices and wages are rigid, it is possible that changes in the real wage rate and the level of real output might occur. As pointed out by Gurley and Shaw, “Price flexibility is the unseen hand that may maintain monetary equilibrium with a given nominal stock of money. Price rigidity shackles the unseen hand.”

2. Absence of Money Illusion:

People must be free of money illusion. It means that the behaviour of the people in the economic system must depend on the real and not the nominal value of such variables as output, wages etc.

3. Absence of Distribution Effects:

ADVERTISEMENTS:

Changes in the money supply must not change the distribution of income in the economic system. “Since the society consists of individuals whose tastes are different and for whom the relative attractiveness of saving versus consumption is different, income redistributions can lead to shift in saving schedule and alter the composition of real output, that is, change in relative prices.”

4. Inelastic Expectations:

It is assumed that any equilibrium price level is the permanent price level so that the -rending units have inelastic price expectations. According to Patinkin, static expectations are a necessary assumption for the neutrality of money.

5. Absence of Government Debt or Open Market Operations:

According to Metzler, the neutrality of money requires that there must be absence of government debt or open market operations in the money market.

6. Absence of a Combination of Inside and Outside Money:

For the establishment of neutrality of money, it is essential that economy contains only “outside” or only “inside” money. According to Gurley and Shaw, “Even within a strict neo-classical framework, however, monetary policy may not be neutral on real variables when there exists a combination of inside and outside money.”

7. Perfect Information:

People must have perfect information about the conditions of demand and supply in various markets. If such information is imperfect, changes in the money supply which affect the price level can also influence such real magnitudes as saving, investment, supply and demand for labour, etc. This will lead to non-neutrality of money.

Neutrality of Money in Keynesian System:

In the entire Keynesian system, there are two situations in which money is neutral. The first is the situation of full employment when any increase in the quantity of money brings about a proportionate increase in the price level but output remains unchanged at that level. The second is the special case of liquidity trap. When the economy is in the liquidity trap, there cannot be a further fall in the- rate of interest even if the money supply is increased by monetary authorities.

This implies that there will be no effect on such real variables as investment and income, and all changes in the money supply are added to idle balances. In this situation, money is neutral. However, money is non-neutral in the intermediate situation between these two extreme cases in the Keynesian system.

Does Money Impact Real Output Of Economy Graph

Non-Neutrality of Money in Keynesian & Post – Keynesian Theories:

In the Keynesian system so long as there is unemployment, changes in the money supply produce permanent non-neutral effects on the rate of interest, the level of employment, income and output, the rate of capital formation, and so on. Thus Keynes emphasized non-neutral money and for this he invoked the monetary theory of interest. He wrote: “As soon as we pass to the problem of what determines output and employment as a whole, we require the complete theory of a Monetary Economy.”

The post-Keynesians, particularly Friedman, Burner and Metzler have shown that money is non-neutral in the short-run. According to Friedman, interest rates cannot be used as a guide to monetary policy and that an acceleration in the rate of growth of the money supply produces not lower interest rates but higher ones, if the entire cycle of events is considered. Thus monetary policy cannot peg interest rates except for limited period. Any attempt to do so will only produce sustained inflation, just as would a similar attempt to use monetary policy to hold unemployment below its natural rate.”

Besides, Friedman also believes that money may be non-neutral in the long-run. If there is a permanent acceleration in the growth rate of the money supply, say from 3 per cent to 8 per cent, it will permanently change the level of real income. This implies non-neutrality of money.

This view presupposes that:

(i) Real money balances are a productive factor to business and provider of utility to the wealth holder, and

(ii) Inflation reduces the real balances with business and wealth-holder.

Metzler has developed a non-neutrality money model under open market operations. According to him, when the central bank’s open market operations bring a change in the quantity of money, it will affect the public’s holdings of assets. Thus the equilibrium rate of interest will be determined by monetary forces and money will be non-neutral.

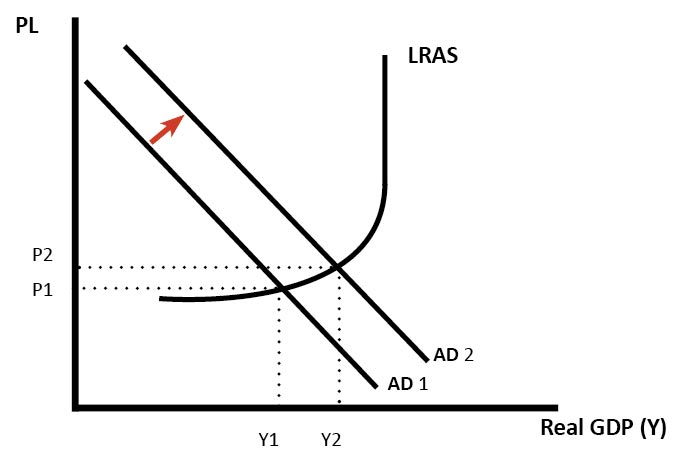

This is illustrated in Fig. 2. where the initial full employment equilibrium is at E0 where, the ISU and LM0 curves intersect so that the full employment real income is Y0 and the corresponding equilibrium interest rate is Or0. Suppose the central bank increases the money supply by purchasing privately held bonds through open market operations. This shifts the LM0 curve to the right to LM1 which intersects the IS0 curve at E1 so that the interest rate is reduced to Or1 and the income rises to OY1. This leads to an inflationary gap, over the full employment income level equal to YY1.

This inflationary process leads to real-balance effect which starts shifting the LM1curve backward towards its original position, as a result of decline in real balances, At the same time, the is curve also starts shifting downwards to the left on account of a reduction in consumption as a consequence of the decline in real balances.

We find that the real balance effect leads to the shifting of the LM1 curve to the position of LM2, curve and of the IS1 curve to ZS, curve in the figure. Full employment equilibrium income OY0 is thus restored at point E2 where the IS, curve intersects the LM2 curve. But the rate of interest has now fallen from Or1 to Orr .This means that money is non-neutral in its effect because the equilibrium rate of interest has been permanently lowered through open market operations.

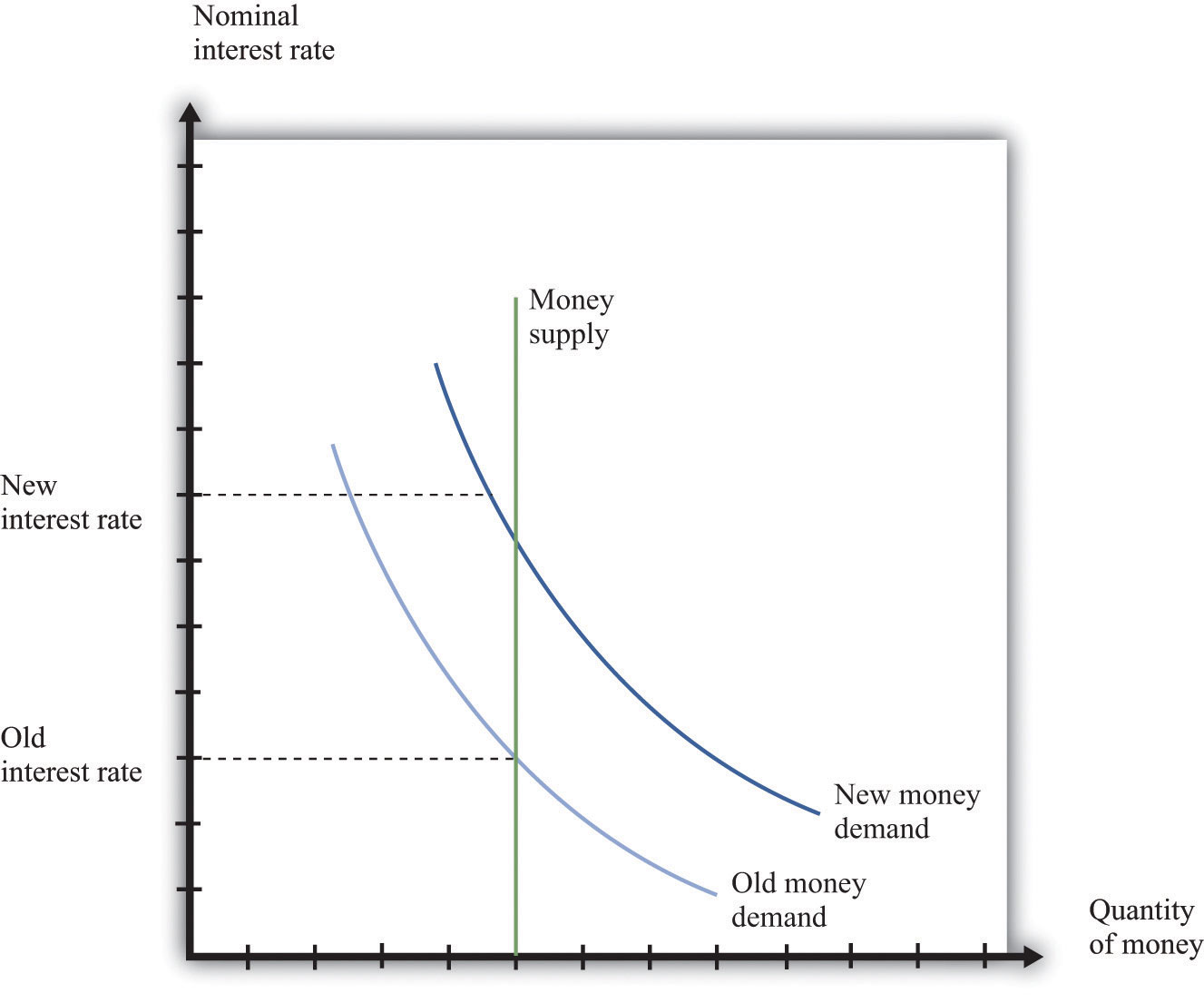

AnswerIn general, the effects of monetary policy on economic activity, through a decline or a rise in (real) interest rates, are as follows.

When interest rates decline, financial institutions can procure funds at low interest rates. This enables them to reduce their lending rates on loans to firms and households. Given the linkage between various financial markets, there is a decline in not only financial institutions' lending rates but also interest rates at which firms borrow directly from the market, such as in the form of corporate bond issuance.

In this situation, firms find it easier to procure working capital (funds needed for the payment of salaries and input costs) and fixed investment funds (funds needed for construction of factories, stores, etc.), and households also find it easier to borrow funds, such as for purchasing housing.

As a result, firms' and households' economic activity picks up, and this stimulates the economy. Upward pressure on prices is also generated in turn.

Such monetary policy measures, aimed at stimulating the economy, are called monetary easing.

On the other hand, when interest rates rise, financial institutions must procure funds at higher interest rates, and raise their lending rates on loans to firms and households. Firms and households find it difficult to borrow funds, which makes their economic activity sluggish. This, in turn, contains overheating of the economy and exerts downward pressure on prices.

Such monetary policy measures, aimed at containing an overheating of the economy, are called monetary tightening.