How Does A Decrease In Real Income Affect Money Demand

- How Does A Decrease In Real Income Affect Money Demand As A

- How Does A Decrease In Real Income Affect Money Demand For A

- How Does A Decrease In Real Income Affect Money Demand Curve

- How Does A Decrease In Real Income Affect Money Demand Will

Last updated: February 2, 2000

As income increases so does demand. If manufacturers ramp up to meet demand, they create jobs. Workers' wages rise, creating more spending. It's a virtuous cycle leading to ongoing economic expansion. If demand increases but manufacturers don't increase supply, then they will raise prices. That creates inflation.

Note: These notes are preliminary and incomplete and they are not guaranteed to be free of errors. Please let me know if you find typos or other errors.

The Asset Market

Up to now we have covered (1) the labor market and the production function, where real wages, employment and potential output is determined, and (2) the market for goods and services, where the real interest rate and investment and saving are determined. Now we consider the market for financial assets (money and 'bonds') by focusing on the demand and supply of money in the economy. This will give us insights into other forces on interest rates - particularly those created by the Fed - and also on the ultimate determinants of inflation.

What is Money?

- Medium of exchange - barter is inefficient.

- Unit of account - money is the basic unit for measuring economic value.

- Store of value - money can be used to hold wealth.

- Low return (interest rate) - money pays no interest

- Low risk - money is a 'safe' asset in low inflation times

- High liquidity - money is the most liquid asset (money is accepted immediately for almost all transactions)

Definitions of monetary aggregates

| Symbol | Assets Included | Billions of dollars (1996) |

| C | Currency | $358.9 |

| M1 | Currency, demand deposits, traveler's checks, checkable deposits. | $1,095.3 |

| M2 | Currency, M1, overnight repos, eurodollars, money market deposit accounts, money market mutual funds, saving and small time deposits. | $3,761.1 |

In this class, when we talk about the nominal money supply we will generally be referring to the monetary aggregate M1. Hereafter, the symbol 'M' will denote M1.

The supply of money

The Federal Reserve Bank (Fed)

The Federal Reserve Bank (Fed) ultimately controls the supply of money in the economy. (How it does this and how the banking system works is detailed in the lectures on the Fed and Monetary Policy.) The Fed is the central bank for the U.S. and is a quasi-private entity (technically owned by private banks) created by the Federal Reserve Act in 1913. There are twelve regional Federal Reserve Banks across the country and the leadership of the system is conducted by the Board of Governors of the Federal Reserve System (Federal Reserve Board ). The Board consists of seven governors, appointed by the President to staggered fourteen-year terms. The President appoints one Board member as chairman - currently Allen Greenspan - for a term of four years. It is important to keep in mind that the Fed operates independently of the federal government. Congress and the President do not have direct control over the operations of the Fed.

How the Fed Controls the Money Supply

The Fed primarily controls the supply of money (M1) in the economy through what are called open market operations. These are the purchase and sale of government bonds by the Fed. The Fed operates the printing presses for the creation of currency. The Fed also owns a substantial amount of U.S. government bonds. When the Fed wants to increase the supply of money it performs an open market purchase of government bonds. That is, the Fed buys (by printing money) outstanding government bonds from the public or new government bonds from the Treasury (to finance the current deficit). This operations injects new cash into the economy. Conversely, when the Fed wants to decease the amount of money in the economy it performs an open market sale of government bonds. Here, the Fed sells some of its holdings of government bonds to the public in exchange for cash. This operation takes cash out of the economy.

Portfolio Allocation and the Demand for Assets

Portfolio theory tells us how individuals allocate their wealth among a number of financial assets (e.g. stocks, bonds, real estate, money). In general an individual's demand for assets is based on comparing the benefits of costs of holding different kinds of assets. These costs and benefits are functions of the following assets characteristics:

- Expected return - expected gain (or loss) from holding an asset over a particular investment horizon

- Risk - the degree of uncertainty in an asset's return

- Liquidity - the ease and quickness that an asset can be traded

An individual's demand for money is then based on the costs and benefits of holding money. As an asset, money has a very low expected return (it pays no interest), is very safe (the gov't guarantees its nominal value) and is the most liquid asset.

Simplifying assumptions

Since the general asset allocation problem involves many different kinds of assets with different risk and return characteristics we simplify this decision by assuming that there are only two kinds of financial assets in the economy.

- Money assets - low return, high liquidity and low risk. im = nominal interest rate on money assets (very low).

- Non-money assets (bonds) - higher return than on money assets and less liquidity. We assume that the risk associated with investing in bonds is not too high (think of government bonds as the generic non-money asset). Let i denote the nominal interest rate on non-money assets. Note that, by assumption, i > im. Also, recall that i = r +pe, where r denotes the real return on non-money assets and pe denotes expected inflation.

Behavorial Model for Money Demand

How Does A Decrease In Real Income Affect Money Demand As A

Our model for the demand for nominal money balances takes the following form

Md = P·Ld(Y, i)

where

- Md = demand for nominal money balances (demand for M1)

- Ld= demand for liquidity function

- P = aggregate price level (CPI or GDP deflator)

- Y = real income (real GDP)

- i = nominal interest rate on non-money assets

Discussion

- Nominal money demand is proportional to the price level. For example, if prices go up by 10% then individuals need 10% more money for transactions.

- As Y increases, desired consumption increases and so individuals need more money for the increased number of desired transactions. This is the liquidity demand for money.

- As the nominal interest rate on non-money assets (bonds), i, increases the opportunity cost of holding money increases and so the demand for nominal money balances decreases.

- Since i = r + pe, we can decompose the effects on an increase in i into real interest rate increases (holding expected inflation fixed) and expected inflation increases (holding the real interest rate fixed).

The demand for real balances

Since the demand for nominal balances is proportional to the aggregate price level, we can divide both sides of the nominal money demand equation by P. This gives the liquidity demand function or the demand for real balances function:

MD = Md/P = Ld(Y, i)

How Does A Decrease In Real Income Affect Money Demand For A

The left-hand-side of the above equation is the demand for nominal balances divided by the aggregate price level or the demand for real balances (the real purchasing power of money). The right-hand side is the liquidity demand function. The demand for real balances is decomposed into a transactions demand for money (captured by Y) and a portfolio demand for money (captured by i).

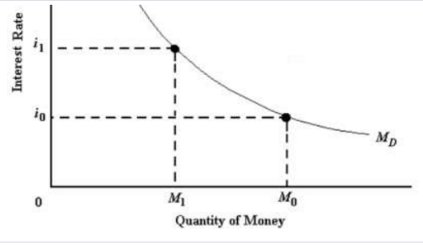

The real money demand function is graphed below:

Whenever income or expected inflation change the real money demand curves shifts. For example, if Y increases the real money demand function shifts up and right; if expected inflation increases the real money demand function shifts down and left.

Equilibrium in the money market

Real money demand and the real money supply as functions of the real interest rate are illustrated in the above graph. Real money demand is graphed holding fixed real income and expected inflation. The real money supply is equal to the nominal amount of M1, denoted M0, divided by the fixed aggregate price level, P0. It is assumed that the Fed does not alter the money supply based on the valued of the real interest rate. Therefore, the real money supply function is a vertical line in the graph with the real interest rate on the vertical axis and real money balances on the horizontal axis.

How Does A Decrease In Real Income Affect Money Demand Curve

Notice that real money demand and real money supply intersect when the real interest rate is r0. This is the value of the real interest that equates money demand with the money supply and establishes equilibrium in the money market. When the money market is in equilibrium there are no economic forces acting on the economy to alter the real interest rate.

If the real interest rate were r1 then the demand for real balances would be greater than the fixed supply of real balances (as illustrated above). In this case we say there is an excess supply of money in the money market. Practically, what this means is that individuals are holding more money than they would like given the high real interest rate. Accordingly, individuals will attempt to rebalance their portfolios; i.e. they will try to get rid of money by buying bonds (our generic non-money asset). In doing so the demand for bonds increases and so the price of bonds increases. Because bond prices are inversely related to the interest rate on bonds, the increased price of bonds lowers the real return on bonds (holding expected inflation fixed). Therefore, the excess supply of money at r1 (dis-equilibrium in the money market) leads to economic forces that act to lower the real interest rate. These forces cease to operate when the real interest falls to r0 where the demand for real balances is equal to the supply of real balances.

Comparative statics

Increase in the nominal money supply (M)

Consider the money market initially in equilibrium at r = 6% as illustrated in the above graph.. Suppose the Fed increases the nominal money supply by an open market purchase of government bonds. This increases the money supply from M0 to M1. Holding the price level fixed, this increases the supply of real balances from M0/P0to M1/P0. If the real interest rate stays at 6% then the supply of real balances will be greater than the demand for real balances: there will be an excess supply of money in the money market. Consequently, individuals will try to get rid of the excess money by buying bonds which puts downward pressure on the real interest rate (holding expected inflation fixed). As r drops we move along the liquidity demand curve toward the new equilibrium at r = 5%.

Increase in the aggregate price level (P)

Consider the money market initially in equilibrium at r = 6% described in the graph below. Now suppose that the aggregate price level increases from P0 to P1. Holding the nominal money supply fixed, this reduces the supply of real balances from M0/P0 to M0/P1. If the real interest rate stays at 6% the supply of real balances will be less than the demand for real balances: there will be an excess demand for money. The excess demand for money will prompt individuals to sell bonds (demand for bonds falls) and so the real interest rate on bonds will rise. As r rises, we move up along the liquidity demand curve toward the new equilibrium at r = 7%.

Consider the money market in equilibrium at r = 6% as illustrated above. Suppose that current income (Y), which is the same as current output (GDP),. Increases from Y0 to Y1. This increases the transactions demand for money as so the real money demand curve shifts up and to the right. If the real interest rate stays at 6% there will be an excess demand for money which puts upward pressure on the real interest rate. As r increases, we move along the money demand curve up towad the new equilibrium at r = 8%.

Let us make an in-depth study of the linking variables between interest rate and income.

Introduction:

The interest rate and income are linking variables transmitting changes from the monetary sector to the goods sector and from the goods sector to the money sector. We now examine this relationship in more detail and analyse the concept of general equilibrium in the whole economy, consisting of the goods and money sectors.

Fig. 6.1 is a summary of equilibrium in the two sectors. The IS and LM curves represent the conditions that have to be satisfied in order for the goods and money sectors, respectively, to be in equilibrium. Now our task is to determine how these markets are brought into simultaneous equilibrium. For simultaneous equilibrium, interest rates and income levels have to be such that both goods market and money market are in equilibrium.

ADVERTISEMENTS:

That condition is satisfied at the point E in Fig. 6.1 which is the point of general equilibrium. This occurs at one combination of real income and the interest rate re and Ye and with this combination of income and interest rate there is no tendency for anything to change; individuals are in equilibrium in their allocation of wealth among different assets, and in their allocation of output among different uses.

Even though we are not concerned with the problem of economic dynamics, it is nevertheless important to understand the economic forces generated in this equilibrium, which tend to bring the system back to equilibrium.

Fig. 6.2(b) represents the equilibrium conditions for the goods and money sectors. Fig. 6.2(c) shows the money sector from which the LM curve in Fig.6.2(b) is derived and Fig 6.2(a) shows the desired investment schedule which together with the consumption function (not shown here) was used to derive the IS curve in Fig 6.2(b).

Point A shows the combination of real income (Y2) and interest rate (re) , respectively, which represents general equilibrium for the economy. At point A in the money sector, the quantity of money demanded shown by the demand curve Y2 is equal to the quantity of money supplied. At the interest rate re, desired investment is equal to IA – this is shown in Fig. 6.2(a). As point A is on the IS curve, we know that saving generated by a real income of Y2 is equal to IA, because every point on the IS curve represents a situation in which saving is equal to desired investment.

Let us consider point B in Fig. 6.2(b) which shows the combination of real income and interest rate Y2 and rB, respectively. We want to know what forces will be generated when the economy found itself in the situation represented by point B, and how these forces will work to bring the economy back to equilibrium. We know that at point B neither the goods nor the money sector is in equilibrium, because point B, is off both the IS and LM curves. Thus, something will have to change in both sectors.

In the money sector 6.2(c), we can see that at the combination of income and interest rate represented by point B, the quantity of money demanded is less than the quantity of money supplied. Individuals will try to re-allocate their wealth from money to bonds, thus pushing interest rate down. The arrow pointing down at B represents this tendency.

At panel 6.2(a), we see that at the interest rate rB, desired investment is IB. However, at real income Y2, saving is equal to IA, because we assume that S is a function of real income only; thus at point B, S > IB. Hence in the goods sector, point B represents a situation in which AD < Y. Given our present assumption about the effects of a disequilibrium in the goods sector, S > (desired) I will tend to reduce output (real income).

The arrow pointing to the left at B represents this tendency. (According to our assumptions about the goods sector disequilibrium, this only affects output, not the price level and as such it does not affect the LM curve).

The initial forces generated in disequilibrium have further repercussions on the whole economic system. The fall in the interest rate generated by excess supply of money will affect desired I =f(r). The fall in real income F generated by S > I (desired) in the goods sector will affect the demand for money, which is a function of real Y only. As the interest rate falls, desired I rises, reducing S > I (desired). As real Y falls, the demand for money and the interest rate fall, strengthening the effects mentioned above. All of this will continue until point A is reached — equilibrium point, in Fig. 6.2.

Disequilibrium and Dynamics in the Goods and Money Market:

Equilibrium is said to be a stable one when economic forces tend to push the market towards it. Fig. 6.3 shows that the general equilibrium described here is indeed a stable one. To show this, we consider all the points to the left of the IS curve, like point A where interest rate r1 and the level of Y1 are too low for equilibrium to be achieved in the real sector. This means that the total value of output is less than the demand.

In this situation, businesses find their inventories run down involuntarily and so act to increase output which pushes up Y. For all points to the left of the IS curve, there is an excess demand for goods and thus there is pressure on income to rise. Similarly, tor all points to the right of the IS curve, there is excess supply of goods and there is pressure on Y to fall.

Now we consider points above the LM curve, like point B. At this point, with the level of Y, OY1, the interest rate is too high for money market equilibrium to be achieved. This means that the supply of money exceeds the demand for money and so downward pressure is exerted on the interest rate. This is true for all points above the LM curve, as shown in Fig. 6.3 and it is also true that upward pressure will be exerted on interest rates at all points below the LM curve as there is excess demand for money.

The direction of the pressure being exerted on incomes and interest rates in the four quadrants are indicated by arrows in Fig. 6.3. At any disequilibrium point, such as C, economic forces will be pushing the market towards the general equilibrium position.

Shifting the IS and LM Curves:

Having analysed equilibrium in the two sectors, it is useful to examine how changes in behaviour will affect the two variables in which we are interested at present — real income and interest rate. There are four behavioural functions that determine equilibrium in the two sectors – the investment function and consumption function and the supply of money function and the demand for money function.

These functions were used to derive the IS and the LM curves and thus the behaviour represented by these functions is held constant along the IS and LM curves. A change is behaviour can be represented by a shift in these functions. Such shifts will result in the shift of the IS or LM curves, or, both.

ADVERTISEMENTS:

Let us start from a situation of general equilibrium as shown by point A in Fig. 6.4. This is an equilibrium for that set of behavioural functions which underlies the derivation of the IS and LM curves intersecting at A. We now assume that for some reason, desired expenditures increase. For example, suppose there is an increase in desired investment at all interest rates (a shift in the investment function) or a rise in desired consumption at all income levels (a shift in the consumption function). These changes can be represented by a shift of the IS curve from IS to I’S’.

Now the economy is no longer in equilibrium at A because the goods sector now represented by I’S’ is no longer in equilibrium. However, the money sector is still in equilibrium as there is no change in the behaviour of the functions which affect money sector. We know that with the new IS curve, point A represents a situation in which desired expenditures are greater than total output (or I > S ). This will lead to an increase in Y.

As real Y rises, point A no longer represents equilibrium in the money sector either, because the increase in real Y affects the quantity of money demanded and thus equilibrium in the money sector will also change, though has been no behavioural change in the money sector (and hence the LM curve does not shift; there is a movement along the curve). The rise in the interest rate will’ have effects on desired I and on real Y.

This process will continue until a new equilibrium is reached at B with interest rate at rB and real income at YB. At B, both the money and goods sectors are in equilibrium. It may be pointed out here that if the shift in desired expenditures or AD had not affected the interest rate, real income would have changed from YA to Yc, which is equal to the initial change ‘in AD x the multiplier. This would be true if the LM curve is horizontal. Real Y only rises to YB because some of the initial increase in AD is offset by the effect of the rise in the interest rate on desired I, called the ‘crowding-out effect’.

A shift of the LM curve can occur because of a change in the demand for money or in the supply of money. An increase in the supply of money or a decrease in the demand for money can be represented by a shift of the LM curve to the right. To examine the effect of such changes, let us again start from a position of equilibrium at point A in Fig. 6.5. Assume there is an increase in the supply of money brought about by an open-market operation by the monetary authority. With the new money supply, equilibrium in the money sector can be represented by L’M’ curve in Fig. 6.5.

At A, the goods sector is still in equilibrium, since nothing has happened to change the IS curve. However at A, the quantity of money supplied is greater than the quantity of money demanded as the situation in the money sector represented by the L’M’ curve. Individuals will be attempting to reallocate their wealth from money into bonds, thus driving the interest down.

The fall in interest rate also affects the goods sector via its effect on desired I; thus point A will not remain an equilibrium point for the goods sector either. The changes in the goods sector thus generated will have repercussions on the money sector. The process will continue until a new equilibrium is reached at point B, at which both sectors are in equilibrium again.

How Does A Decrease In Real Income Affect Money Demand Will

ADVERTISEMENTS:

The above discussion shows how changes in one sector of the economy are transmitted to the other sectors, and how the final equilibrium of the whole system is reached. It is obvious that changes occurring in one sector can only be transmitted to another sector if there exist variables linking the two sectors, and if these changes affect these linking variables.

In our model, the linking variables are the interest rate and real Y. The interest rate is an effective linking variable, transmitting changes of behaviour occurring in the money sector to the goods sector, because the change in the money sector had an effect on the interest rate and the interest rate enters in the goods sector through investment decisions.

Real Y is an effective linking variable, transmitting changes of behaviour in the goods sector to the money sector, because changes of behaviour in the goods sector has an effect on real income Y and real Y enters into decision in the money sector through changes in the demand for money.

To get a better idea about these linking variables, we examine the following cases:

i. The Perfectly Elastic Demand for Money or the Liquidity Trap:

We have already seen the interest rate as a measure of the alternative cost of holding wealth in the form of money rather than in the form of other assets and thus, as a measure of the cost of acquiring the services yielded by money. When the interest rate is zero, the cost of acquiring services provided by money is zero and people will be willing to hold all their wealth in the form of money rather than other assets.

It is possible that even when the interest rate is positive, the expected cost of holding wealth in the form of money is zero. We have already seen that one of the costs of holding bonds is the risk of capital loss arising from a change in the interest rate. When the interest rate rises, there would be a fall in the capital value of bonds; the expected return from holding a bond is equal to the interest yield minus the expected capital toss. If these two are equal, the expected final return is still zero, even though the interest yield is positive.

Assume for the moment that the interest rate is considered to be normal, say, rn. If the interest rate falls below rn , individuals expect it to return to rn and thus they expect to suffer a capital loss if they hold bonds. Let rL < rn be the interest rate which would cause capital loss if the interest rate rises from r, to the expected rate rn which exactly offsets the return represented by rL.

In this case, at the interest rate rL, the expected return from holding a bond is zero. At the interest rate above rL, it is positive, and at an interest rate below rL, it is negative. This case is represented by a demand curve for money which becomes perfectly elastic at the interest rate rL in Fig. 6.6.

Fig. 6.6 (a) shows 3 demand curves for money for three different incomes, where Y1 < Y2 < Y3, having the property that at the interest rate rL they become perfectly elastic — at this interest rate people are willing to hold all their wealth in the form of money. Ms1 and Ms2 are two different supply curves of money. In Fig. 6.6 (b), the LM curves are derived to represent this situation. They are perfectly elastic at the interest rate rL for incomes up to Y2 for LM1 and up to Y3 for LM2.

The increase in money supply from Ms1 to MS2 only affects the elastic part of the LM curve, because an increase in the supply of money along the perfectly elastic part of the demand curve for money has no effect on the interest rate. Individuals are willing to hold more money, rather than bonds at rL, where the cost of holding money is zero and individuals are indifferent between money and bonds.

ADVERTISEMENTS:

Fig. 6.7 represents a general equilibrium situation for a goods sector represented by IS curve and a money sector exhibiting the properties above, represented by LM, with equilibrium for both sectors on the horizontal part of the LM curve at Ye and rL, respectively. Assume there is an increase in the supply of money shown by a shift of the LM curve from LM1 to LM2. This has no effect on the equilibrium value of real Y or the interest rate because the part of the LM curve affected by this change is not relevant to the determination of equilibrium.

ii. The Supply of Money is Perfectly Elastic:

This happens when the monetary authority decides to fix the interest rate at some given level. To do this, they will have to supply whatever quantity of money is demanded at that rate, otherwise the interest rate would be affected by the excess demand or supply of money and would not be maintained at the desired level. This is shown in Fig. 6.8(a) which shows a supply curve that is perfectly elastic at the interest rate rf and three demand curves for three incomes. In Fig. 6.8(b), we derive the LM curve for this situation. It is perfectly elastic at the interest rate rf. We can see that any changes in the demand for money (or price level) will have no effect on the LM curve.

If we draw the IS curve on the LM curve of Fig. 6.8(b), we have the same general equilibrium situation as the one in Fig. 6.7. Again changes in the demand for money (or price level) will have no effect on equilibrium Y or interest rate. This is the situation which Keynes experienced and thus, he advocated fiscal policy as an effective instrument for influencing the economy.

iii. The Perfectly Inelastic Investment Function:

The IS curve represents all the combinations of income and interest rate at which AD = Total Output. Both the interest rate and real income are relevant here because we assume that both these variables affect decisions about AD; the interest rate affects desired investment and real income affects desired consumption.

If we now drop the assumption that desired investment depends on the interest rate, real Y becomes the only variable that affects AD, and the IS curve in such a situation will be perfectly inelastic. Fig. 6.9 shows such an IS curve with two LM curves representing two different conditions in the money sector (two different supply functions).

With both LM curves, general equilibrium in the two sectors occurs at the same real income but at different interest rates. Thus any changes in the money sector (shifts in the LM curve) only affect the interest rate, but leave real Y unchanged. However, changes in the goods sector (shift of the IS) affect both real Y and the interest rate.

iv. The Real Balance Effect:

The Neo-Classical economists, mainly Prof. Pigou, produced an argument against the Keynesian liquidity trap case in the shape of real balance effect. According to this, with a constant nominal money supply, a general deflation of wages and prices tend to increase the real value of people’s holdings of money above their desired levels.

Consequently, people will reduce their savings and increase their consumption in an attempt to reduce their real balances. In a situation of unemployment, as wages and prices fall and the LM curve shifts to the right, the IS curve will also shift to the right as consumption increases. With both curves now shifting to the right, the equilibrium levels of income and hence employment must increase (even in the liquidity trap and with interest-inelastic investment) and there is now nothing to stop full employment from being reached. This is illustrated in Fig. 6.10.

Theoretically, then, the neo-classical economists appear to have the stronger case. Only when it came to policy-making, did the Keynesians have the upper hand, given the recognised inflexibility of wages and prices downward.

ADVERTISEMENTS:

The cases examined here are important in showing, how, by changing assumptions about behaviour; the inter-relationship between the two sectors is changed. In the first two cases, we still assume that there is a linking variable between the goods and money sectors; desired investment is assumed to be a function of the interest rate.

However, the assumptions about the money sector are such that any changes in this sector do not affect the linking variable (the interest rate) and thus such changes are not transmitted in the goods sector. In the case of the assumption about a perfectly inelastic investment function, the goods sector is totally independent of the money sector — no behaviour in the goods sector is affected by the money sector.

Even if changes in the money sector affect the interest rate, it is unlikely to affect the goods sector so long as the interest rate plays no role in any behaviour relevant to that sector. (If consumption is a function of interest rate, this would reintroduce a link between the goods and the money sectors even though desired investment is not a function of the interest rate). However, changes in the goods sector do affect the money sector, because the variable linking the two – real income — is effective as long as the demand for money is a function of real income which may change because of the real balance effective.

A Formal Treatment of the IS-LM Model:

Equilibrium Income and the Interest Rate:

The intersection of the IS and LM curves determines equilibrium income and interest rate. We derive expressions for these values by using the equations of IS and LM curves.